-

CAR INSURANCE

Car InsuranceFlat 80%* OFFGet right cover at best price on your car insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your car insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your car insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Car Insurance DealsAI-Based Car Insurance RecommendationsHandpicked Insurers for Car InsuranceUnmatched Prices on Car Insurance PremiumsInstant Policy Issuance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TWO-WHEELER INSURANCE

Two-Wheeler InsuranceStarting at Rs.546* only.Get right cover at best price and insure your two-wheeler for a joy ride. Unlock your corporate superpower today.GET QUOTESWhat does your two-wheeler insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your two-wheeler insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Two-wheeler Insurance DealsAI-Based Two-wheeler Insurance RecommendationsHandpicked Insurers for Two-wheeler InsuranceUnmatched Prices on Two-wheeler Insurance PremiumsInstant Policy Issuance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TERM LIFE INSURANCE

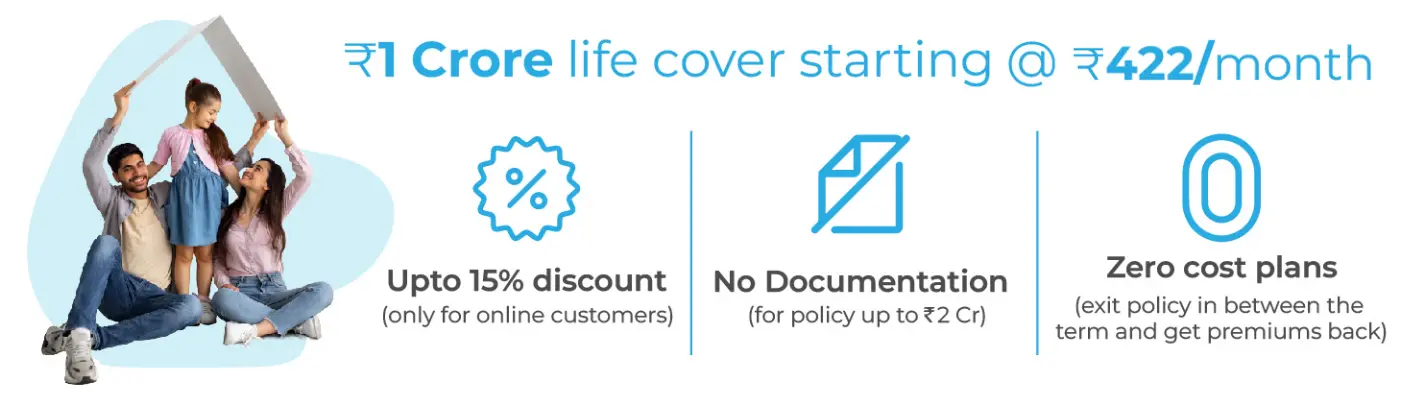

Term Life InsuranceRs.1 crore life cover at Rs.503/month* only.Securing your loved ones future is not expensive, it is priceless! Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your term life insurance cover you for?Death benefitsCritical illnesses coverAccidental death benefitWaiver of premiumMany more add-on coversGet your term life insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Term Life Insurance DealsAI-Based Term Life Insurance RecommendationsHandpicked Insurers for Term Life InsuranceHandpicked Insurers for Term Life InsuranceInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

HEALTH INSURANCE

Health InsuranceGet Rs.5 lakh health cover at Rs.18/day* only.Protecting your health is always our priority. Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your health insurance cover you for?Unexpected medical billsPre and post hospitalisation billsDay care treatmentsMaternity, newborn care and organ donor expensesMany more add-on coversGet your health insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Health Insurance DealsAI-Based Health Insurance RecommendationsHandpicked Insurers for Health InsuranceUnmatched Prices on Health Insurance PremiumsInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

CYBER PROTECT

Cyber Protect InsuranceGet Rs.1 lakh cyber protection cover at Rs.55/day* only.Don't be a victim of cyber fraud! Get right cover at best price on your cyber insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your cyber insurance cover you for?Legal protectionUnauthorised online transaction coverPhishing and email spoofing coverCyber stalking and identity theft coverCyber extortion and many more coveragesGet your cyber insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Cyber Insurance DealsAI-Based Cyber Insurance RecommendationsHandpicked Insurers for Cyber InsuranceUnmatched Prices on Cyber Insurance PremiumsInstant Policy Issuance for your cyber protection100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

OTHER PRODUCTS

Critical Illness InsuranceA must-have protection to secure you against critical illnesses.GET QUOTESPersonal Accident InsuranceAccidents are sudden and can cause damage to your financial planning as well.GET QUOTESClose

Compare & Buy

Term Life Insurance

Exclusive discounts and corporate offers

Years

Tobacco/Nicotine

Your quote, policy and all communications will be sent on

it.

Mobile No. will be your Customer Login ID

Your information stays between us. We never, ever sell your info to third parties - we hate

spam, too.

By clicking on "View Quotes", you agree to our Privacy Policy and Terms & Conditions

By clicking on "View Quotes", you agree to our Privacy Policy and Terms & Conditions

Best Term Life Insurance plans in

3 Easy Steps

Compare, Select & Buy

Complete Medicals & Documentation

Get Policy Issued

Your work email ID can unlock exclusive benefits

Corporate Employee Engagement Program

Corporate Superpower

Assistance from Experts

Best Price

Digital Relationship Manager

Handpicked Insurers

Best In-Class Claim Service

Laxmi revealing exclusive deals on Term Life Insurance

Unleash the power of AI-driven term life insurance recommendations, a dedicated relationship manager, and personalized plans designed just for you. Navigate confidently towards securing your family’s financial future, guided by Elephant.in's expertise and commitment to your peace of mind.

Watch this short video by Laxmi - Your friendly AI advisor who will handhold you through the entire process and make your insurance experience seamless!

Our Insurance Partners

+  +

+

+

+ What is Term Life Insurance?

Term life insurance is a safety net for your dependents in case of unfortunate and untimely death. This insurance is recommended especially for those who are sole breadwinner of their family. It is the cheapest way to cover yourself which enables you to support a worry-free financial future for your family.

How Term Life Insurance Works?

When you buy a term life insurance policy, the insurance company determines the premiums based on your age, gender, sum assured and health conditions. The insurance company may also inquire about your current medications, smoking status, occupation, hobbies, and family history. If there is an unfortunate death of the life assured during the policy term, the insurer will pay the policy’s face value to your beneficiaries. The benefit pay-outs may be used by beneficiaries to settle pending debts and have a stable living in your absence. However, if the policy expires before life assured’s death, there is no pay out given to anyone. But today there are plans available in the market which helps you get back your premiums on maturity.

Benefits of purchasing Term Life Insurance:

- To replace lost income and pay living expenses

- Cater to your family's lifestyle requirements

- Ensures financial protection against liabilities

- Tax savings

- Financial security for Kids in your absence

Additional Covers

Term Life Insurance offers customers to add additional coverages to their base life policies. The benefits can be added at an additional nominal cost. Below are few additional coverages offered:

- Accidental Death Benefit

- Critical Illness Benefit

- Accidental Disability Benefit

- Waiver of Premium Benefit

Importance of Term Life Insurance:

Simply because life is uncertain, and one can never predict what the future holds!

You hold the key to provide your family with adequate income in case of an unfortunate death.

- Financial stability by securing the future at various life stage i.e., when you are young & unmarried, newly married, when you become a parent

- Tax Benefits: Premiums paid are eligible for tax-benefits under Section 80C and Section 80D# of Income Tax Act

- Boost your term plan by increasing cover amount

- Various riders (add-ons) available

- Very low premiums to protect your family when you need it most

- Tax free death benefit under Section 10 (10D) of Income Tax Act

- Highly Flexible and tailor-made plans available

- Very low claim rejection

- Fixed premiums for entire term plan, you pay much less in total

Help Section/FAQ:

You will receive personalized recommendation from Laxmi - the Artificial Intelligence, who is a friendly advisor and will hand-hold you through the entire process and recommend a solution that is a perfect fit for you.

Elephant.in offers a dedicated Digital Relationship Managers to cater all your issues any time after you buy a policy and for the same reason, you get assigned with a dedicated digital relationship manager for any support. Someone's always there to rescue!

Yes, things do go wrong but at Elephant.in we provide best-in-class claims service through our experienced and dedicated claims experts who will help you manage your claims effortlessly.

At Elephant.in insurance companies have been handpicked basis their service, prices and claims paying capability to create a smooth experience.

Disclaimer: The premium amount of Rs 422 (excluding GST) per month is calculated for Bajaj Allianz Life Smart Protect Goal with UIN: 116N163V01 considering the 21-year-old Male, salaried, nonsmoker, Sum Assured of Rs. 1 Crore, policy term 19 years with an annual income above Rs. 10 lacs and is a graduate, discount of up to 6% online discount included (for 1st year), 1% Autopay Discount Included (lifetime) , 5% New to Life Insurance Customer Discount Included (for 1st year), 5% discount for salaried included (for 1st year). Prices offered by the insurer are as per the IRDAI approved insurance plans. All savings and online discounts are provided by insurers as per IRDAI approved insurance plans which may vary as and when amendments done under any plans by any insurance companies.

No documentation means a customer is not required to submit his/her salary slips and bank statement provided an employee is salaried, graduate and above income being min. INR 5 lakhs, sum assured up to 2 Crore for age bracket being 18yrs to 45 yrs. In case, customer’s details are available at “Central KYC Registry” then “Know Your Customer” (KYC) details are not required.

The above exclusivity is subjected to income estimator calculations done at select insurance company’s end.

Zero Cost - Zero-cost insurance option also known as Premium Back option/ Smart exit value option is offered by multiple insurance companies. This option can be exercised by adhering to the conditions specified by respective insurance companies under their term plans. This option shall be applicable on the base cover premium only and not on premiums paid towards additional optional benefits. The premium back amount received does not include GST. Standard T&C apply. Product information is authentic and solely based on the information received from the Insurer.

What our Customers Say

Alliance Insurance Brokers Pvt. Ltd.

8th Floor, Gold Crest, 10th Road, Juhu, Vile Parle (W), Mumbai 400

049, India

Email

Monday - Saturday

9:30 am - 6:30 pm IST

CIN: U67200MH2003PTC141621

IRDAI Registration No.: 217

Valid from : 13/10/2024 to 12/10/2027

Category : Composite Broker

Principal Officer Name: Mr. S. V. Thakkar

CIN: U67200MH2003PTC141621

IRDAI Registration No.: 217

Valid from : 13/10/2024 to 12/10/2027

Category : Composite Broker

Principal Officer Name: Mr. S. V. Thakkar