-

CAR INSURANCE

Car InsuranceFlat 80%* OFFGet right cover at best price on your car insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your car insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your car insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Car Insurance DealsAI-Based Car Insurance RecommendationsHandpicked Insurers for Car InsuranceUnmatched Prices on Car Insurance PremiumsInstant Policy Insurance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TWO-WHEELER INSURANCE

Two-Wheeler InsuranceStarting at Rs.546* only.Get right cover at best price and insure your two-wheeler for a joy ride. Unlock your corporate superpower today.GET QUOTESWhat does your two-wheeler insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your two-wheeler insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Two-wheeler Insurance DealsAI-Based Two-wheeler Insurance RecommendationsHandpicked Insurers for Two-wheeler InsuranceUnmatched Prices on Two-wheeler Insurance PremiumsInstant Policy Issuance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TERM LIFE INSURANCE

Term Life InsuranceRs.1 crore life cover at Rs.503/month* only.Securing your loved ones future is not expensive, it is priceless! Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your term life insurance cover you for?Death benefitsCritical illnesses coverAccidental death benefitWaiver of premiumMany more add-on coversGet your term life insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Term Life Insurance DealsAI-Based Term Life Insurance RecommendationsHandpicked Insurers for Term Life InsuranceHandpicked Insurers for Term Life InsuranceInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

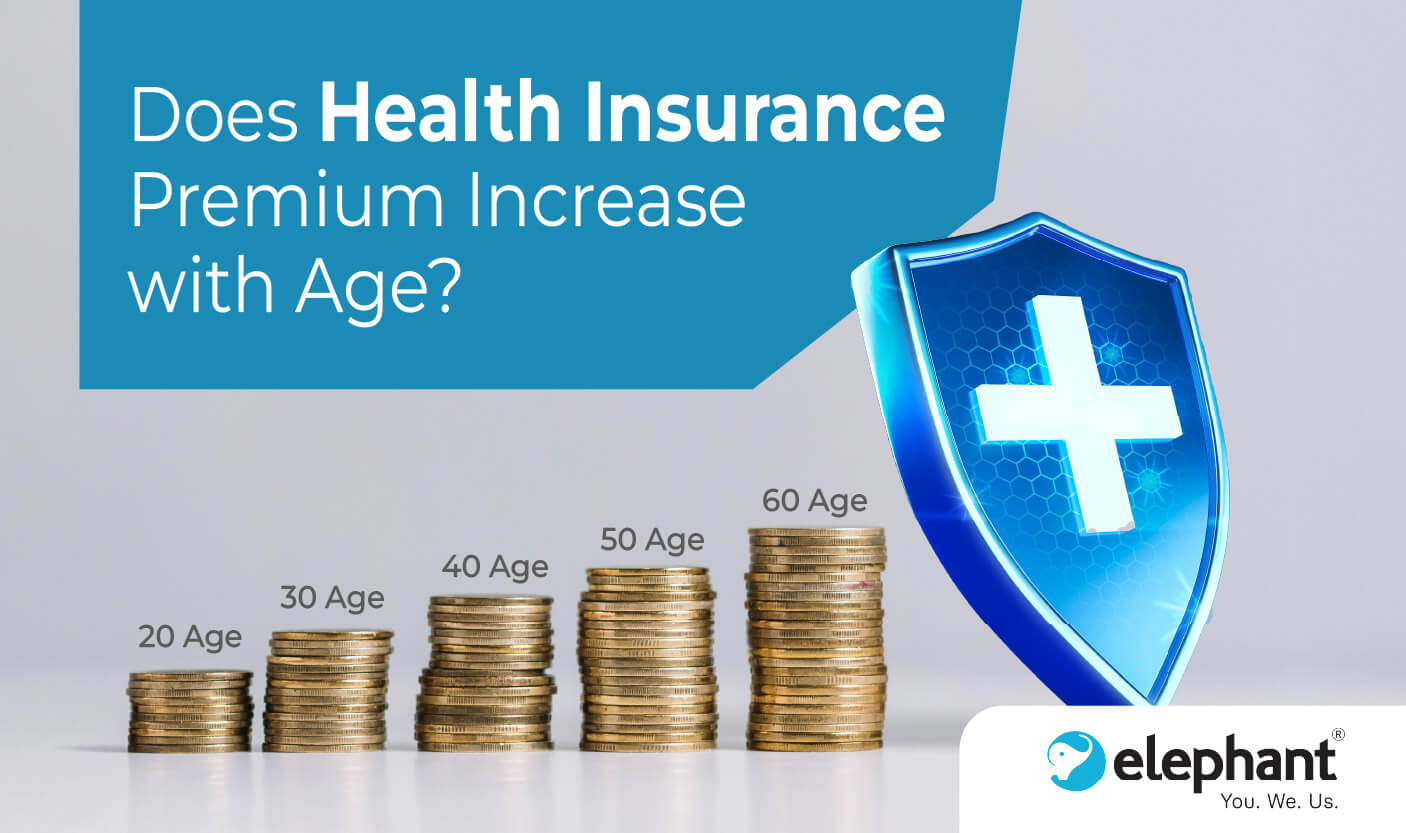

HEALTH INSURANCE

Health InsuranceGet Rs.5 lakh health cover at Rs.18/day* only.Protecting your health is always our priority. Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your health insurance cover you for?Unexpected medical billsPre and post hospitalisation billsDay care treatmentsMaternity, newborn care and organ donor expensesMany more add-on coversGet your health insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Health Insurance DealsAI-Based Health Insurance RecommendationsHandpicked Insurers for Health InsuranceUnmatched Prices on Health Insurance PremiumsInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

CYBER PROTECT

Cyber Protect InsuranceGet Rs.1 lakh cyber protection cover at Rs.55/day* only.Don't be a victim of cyber fraud! Get right cover at best price on your cyber insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your cyber insurance cover you for?Legal protectionUnauthorised online transaction coverPhishing and email spoofing coverCyber stalking and identity theft coverCyber extortion and many more coveragesGet your cyber insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Cyber Insurance DealsAI-Based Cyber Insurance RecommendationsHandpicked Insurers for Cyber InsuranceUnmatched Prices on Cyber Insurance PremiumsInstant Policy Issuance for your cyber protection100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

OTHER PRODUCTS

Critical Illness InsuranceA must-have protection to secure you against critical illnesses.GET QUOTESPersonal Accident InsuranceAccidents are sudden and can cause damage to your financial planning as well.GET QUOTESClose

Hello! You are already a valued customer of Elephant.in!

Login with the phone number ending with to renew this policy.