-

CAR INSURANCE

Car InsuranceFlat 80%* OFFGet right cover at best price on your car insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your car insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your car insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Car Insurance DealsAI-Based Car Insurance RecommendationsHandpicked Insurers for Car InsuranceUnmatched Prices on Car Insurance PremiumsInstant Policy Issuance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TWO-WHEELER INSURANCE

Two-Wheeler InsuranceStarting at Rs.546* only.Get right cover at best price and insure your two-wheeler for a joy ride. Unlock your corporate superpower today.GET QUOTESWhat does your two-wheeler insurance cover you for?Comprehensive coverageLiability coveragePersonal accident coverageZero-depreciation coverMany more add-on coversGet your two-wheeler insured with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Two-wheeler Insurance DealsAI-Based Two-wheeler Insurance RecommendationsHandpicked Insurers for Two-wheeler InsuranceUnmatched Prices on Two-wheeler Insurance PremiumsInstant Policy Issuance for your vehicle100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

TERM LIFE INSURANCE

Term Life InsuranceRs.1 crore life cover at Rs.503/month* only.Securing your loved ones future is not expensive, it is priceless! Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your term life insurance cover you for?Death benefitsCritical illnesses coverAccidental death benefitWaiver of premiumMany more add-on coversGet your term life insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Term Life Insurance DealsAI-Based Term Life Insurance RecommendationsHandpicked Insurers for Term Life InsuranceHandpicked Insurers for Term Life InsuranceInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

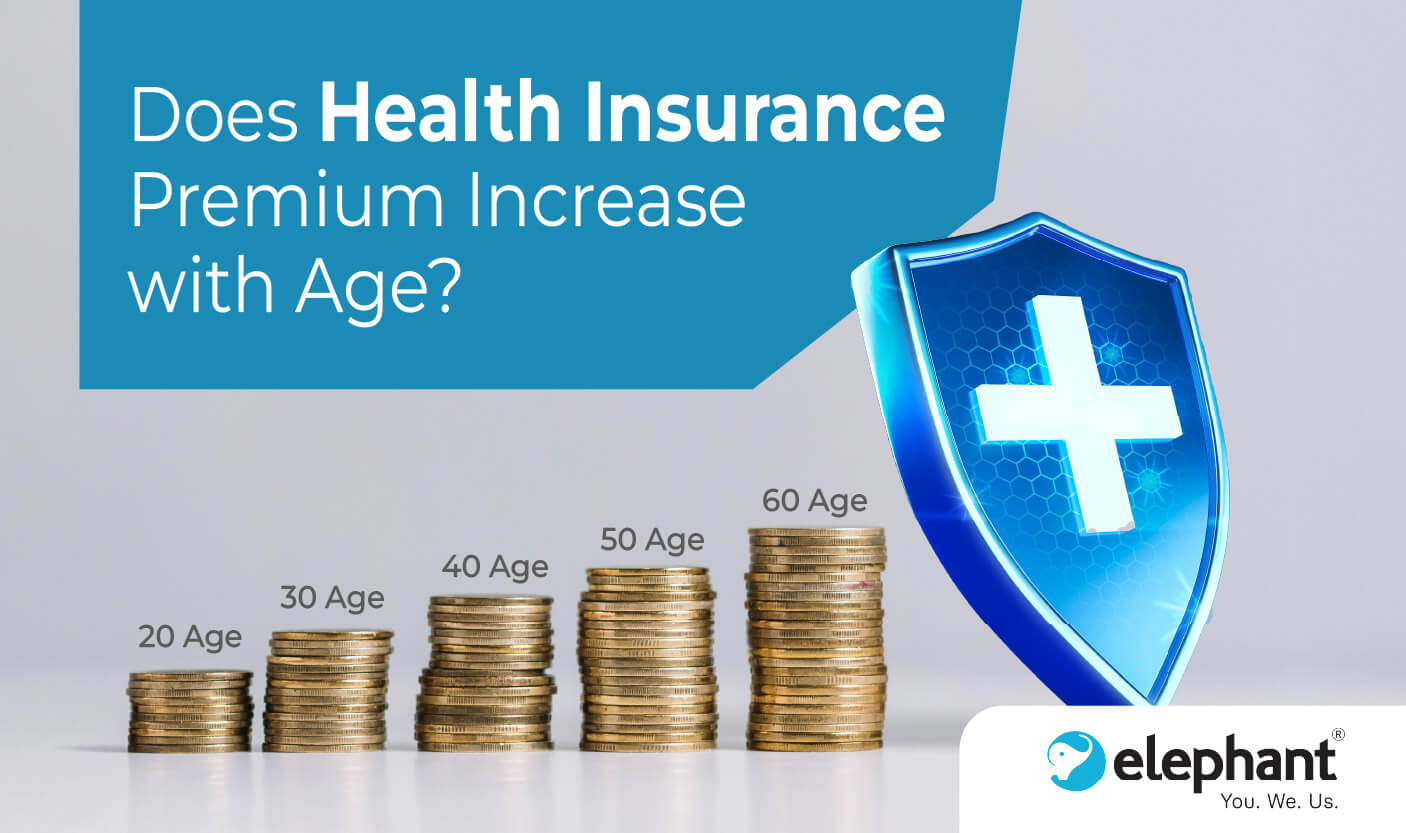

HEALTH INSURANCE

Health InsuranceGet Rs.5 lakh health cover at Rs.18/day* only.Protecting your health is always our priority. Be a superhero by unlocking your corporate superpower today.GET QUOTESWhat does your health insurance cover you for?Unexpected medical billsPre and post hospitalisation billsDay care treatmentsMaternity, newborn care and organ donor expensesMany more add-on coversGet your health insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Health Insurance DealsAI-Based Health Insurance RecommendationsHandpicked Insurers for Health InsuranceUnmatched Prices on Health Insurance PremiumsInstant Policy Issuance for you and your family100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

CYBER PROTECT

Cyber Protect InsuranceGet Rs.1 lakh cyber protection cover at Rs.55/day* only.Don't be a victim of cyber fraud! Get right cover at best price on your cyber insurance policy. Unlock your corporate superpower today.GET QUOTESWhat does your cyber insurance cover you for?Legal protectionUnauthorised online transaction coverPhishing and email spoofing coverCyber stalking and identity theft coverCyber extortion and many more coveragesGet your cyber insurance with the best features - completely online, right now!CloseWhat do you get at Elephant Insurance?Corporate Superpower of best Cyber Insurance DealsAI-Based Cyber Insurance RecommendationsHandpicked Insurers for Cyber InsuranceUnmatched Prices on Cyber Insurance PremiumsInstant Policy Issuance for your cyber protection100% Assistance from ExpertsDigital Relationship ManagerBest-in-Class Claims ServiceLifetime Personalised AccountRenewal Management

-

OTHER PRODUCTS

Critical Illness InsuranceA must-have protection to secure you against critical illnesses.GET QUOTESPersonal Accident InsuranceAccidents are sudden and can cause damage to your financial planning as well.GET QUOTESClose

Get insured from the comfort of your home

Cyber insurance

plans with ₹1 Lakh cover at ₹55/month*

Unauthorized Online Transactions

Individual or Family cover

Email Spoofing

Identity Theft

Phishing

Cyber Stalking

Legal Expenses

Cyber Extortion

Best Cyber Insurance plans in

3 Easy Steps

Fill out the details

Compare Best Prices

Make Payment & Instant Policy

You’re less than 5 minutes away from the best cyber insurance policy. Fill out the details below, see the quotes and get your cyber insurance policy instantly.

Exclusive discounts and offers only for Corporate Employees

Your work email ID can unlock exclusive benefits

Corporate Employee Engagement Program

Corporate Superpower

Best Price

Handpicked Insurers

Assistance from Experts

Digital Relationship Manager

Best In-Class Claim Service

Our Insurance Partners

What is cyber-crime insurance?

Ever since the imposition of lockdown, the meaning of the internet has changed for all of us. The early morning board room meetings turned into chai-sipping zoom sessions. The yoga classes were replaced by time screens on a daily messaging app and restaurants are now confined to cloud kitchen food ordering applications. Our online footprint is growing at an exponential pace, making us more vulnerable to cyber-attacks, identity theft, card frauds, phishing scams, email spoofing, cyber-stalking and virus infection. If you have a life-insurance cover, it is imperative that you have a cover for a medium where you spend your life. Cyber-crime insurance offers just that solution, to modern day professionals who are always online. Insurance against cyber-crime offers a shield and a safety net to various dangers lurking online.

Benefits of a cyber-crime insurance

- 1. Protection in case of Data Breach There are various recuperative costs associated with a data breach. Including but not limited to resetting a security infrastructure, adding additional layers of security/encryption, protection from legal action upon leakage from sensitive data, protecting the identities of the persons adversely affected by the breach and protecting their sensitive data from being misused. (Identity theft, damage to E-reputation, Cyber-bullying)

- 2. Business Loss Considering the dependency on the internet for any business these days, a cyber-attack in any form is detrimental and can bring the business infrastructure down. This insurance will protect you against such an exigency and will remedy the business loss suffered due to such a scenario(E-extortion)

-

3. Legal Cost

The legal procedures of prosecuting criminal cases can be tedious and financially draining, however once you are covered by this insurance, you can rest assured that all your legal costs will be covered, and you will get the best possible legal support and remedy.

Thus, it is explicitly clear that cyber fraud insurance is an essential part of an insurance portfolio of everyone today. It is as important as more generic kinds of insurance.

There are various additional options that one can opt for adding their family members, counselling services, IT consultation services within the coverage umbrella for insurance against cyber-crime. These additional protections and features are available at a reasonable amount as an extension to the main insurance policy. - 4. Defending against phishing & cyber extortion Modern hackers aim to attack business infrastructure by installing ransomware in them and taking them over. They do not relieve the infrastructure and data without payment of ransom fees, much akin to kidnapping and trespass in real life (Unauthorized online transactions, Phishing, email spoofing)

Who needs cyber-crime insurance?

Today, everything from the purchases you make from a vegetable vendor to negotiating multimillion dollar deals, is online. The advent of payment applications and digitisation of work culture has facilitated the shift from offline to online in all aspects. We make digital payments for our purchases, get wire transfers of our salaries, buy insurance online while scrolling social media. The Internet has taken over the life of everyone, a common man, a salaried man, and a businessman. Thus, it is pertinent that everyone takes insurance protection that will protect their online activities. Various industries have moved fully online, others are in the process of digitising their operations. When it comes to cyber-crime insurance policies, employees from various business and industry verticals buy the cyber-crime insurance policy, and these include are not not limited to

Manufaturing

Construction

Infrastructure

Power & Energy

Healthcare

Government agencies

Cloud kitchens

Lawyers

Education services

Financial services

Transportation

Travel and tourism

Why Elephant insurance?

Elephant.in is India’s first insurtech and consultancy platform for corporate employees. It is a modern-day insurance start-up, which takes away the cumbersome procedures of documentation and rounds to the insurance offices. All the procedures are online and seamless. Elephant insurance offers the best coverage plans at competitive rates compared to its industry peers. When you buy a policy from us, we provide a guarantee of clearing your claims within a stipulated time frame. So leave your insurance worries to us, while you surf the internet knowing that we have your back.

What Cyber Insurance plan does not cover:

- Any illegal or malicious activity and any expected gain thereof

- Loss of value, accessibility of cryptocurrency

- Bodily or property damage

- Infringement of IPR

- Any dishonest or immoral conduct

- War or terrorism

- Losses or costs incurred before the policy was bought

- Consequences of change in National cyber policy

- Any act of God or Force Majure

Help Section/FAQ:

Just like the internet opens up various avenues and possibilities, it also makes the user vulnerable to various cyber-attacks. Users can be attacked in various ways, including but not limited to:

- Identity theft

- Social media impersonation

- Cyber stalking

- IT theft

- Malware

- Ransomware

- Phishing

- Email Spoofing

- Cyber extortion

- Data Privacy Breach

- Media Liability

- Hacking

Plans vary in nature and value. There are 2 kinds of plans so far as nature is concerned, first party and third-party having differential coverage. The most glaring difference between both these kinds is with the party who will be filing the claim. Whereas, in a first-party claim, the policy holder is the claimant whereas in third-party claims, the primary claimant ought to be a third party. Whereas there are plans differing from the amount of sum assured varying from Rs. 1 Lakh to Rs. 1 Cr.

Every Indian Citizen, above the age of 18 can purchase a cover, it is easier for you to be protected from cyber threats than to obtain a driving licence.

We are the cool obedient kids on the block, we process claims well within the IRDAI guidelines. So, you have nothing to worry about.

As mentioned hereinabove, cyber-attacks come in various shapes and sizes, an anti-virus essentially works like a vaccine for your computer, despite installing it on the computer you are not 100 % secure from Virus, leave aside various other forms of attack. On the other hand, Cyber fraud insurance provides a comprehensive coverage and monetary remedy for these various attacks.

What our Customers Say

Alliance Insurance Brokers Pvt. Ltd.

8th Floor, Gold Crest, 10th Road, Juhu, Vile Parle (W), Mumbai 400

049, India

Email

Monday - Saturday

9:30 am - 6:30 pm IST

CIN: U67200MH2003PTC141621

IRDAI Registration No.: 217

Valid from : 13/10/2024 to 12/10/2027

Category : Composite Broker

Principal Officer Name: Mr. S. V. Thakkar

CIN: U67200MH2003PTC141621

IRDAI Registration No.: 217

Valid from : 13/10/2024 to 12/10/2027

Category : Composite Broker

Principal Officer Name: Mr. S. V. Thakkar